Book a Free Salesforce Consulting Call

Leverage almost 2 decades of Ascendix’s Salesforce experience today.

Salesforce has become the #1 customer relationship management (CRM) platform and the world’s #4 employer on the Fortune 100 list, with around 80 000 employees and 150,000 product users worldwide. The biggest companies that use Salesforce are:

In this article, we’ve narrowed down the key company statistics pointing out Salesforce’s year-over-year growth.

Salesforce is an extremely popular CRM platform, extensively utilized worldwide. With more than 80,000 employees and 150,000 customers of different sizes and industries, Salesforce is actively used to stream all business functions into a single source of truth. Some of the largest Salesforce customers include Walmart Inc., with an annual revenue of $611.3 billion, and Amazon Web Services, with a revenue of $80 billion.

Top Salesforce customers in the USA are U.S. Bank, Amazon Web Services, American Express, Walmart, and T-Mobile. Overall, more than 59% of Salesforce clients come from the USA, as of the end of 2022.

Salesforce customers list includes more than 150,000 businesses in 2024, though Salesforce customer base is predicted to double by the end of 2026. In the US, the list of Salesforce users comprises the following companies:

It must be mentioned, however, that among all Salesforce’s customers, 49% are small businesses (<50 employees), 40% are medium-sized, and 11% are large (>1000 employees).

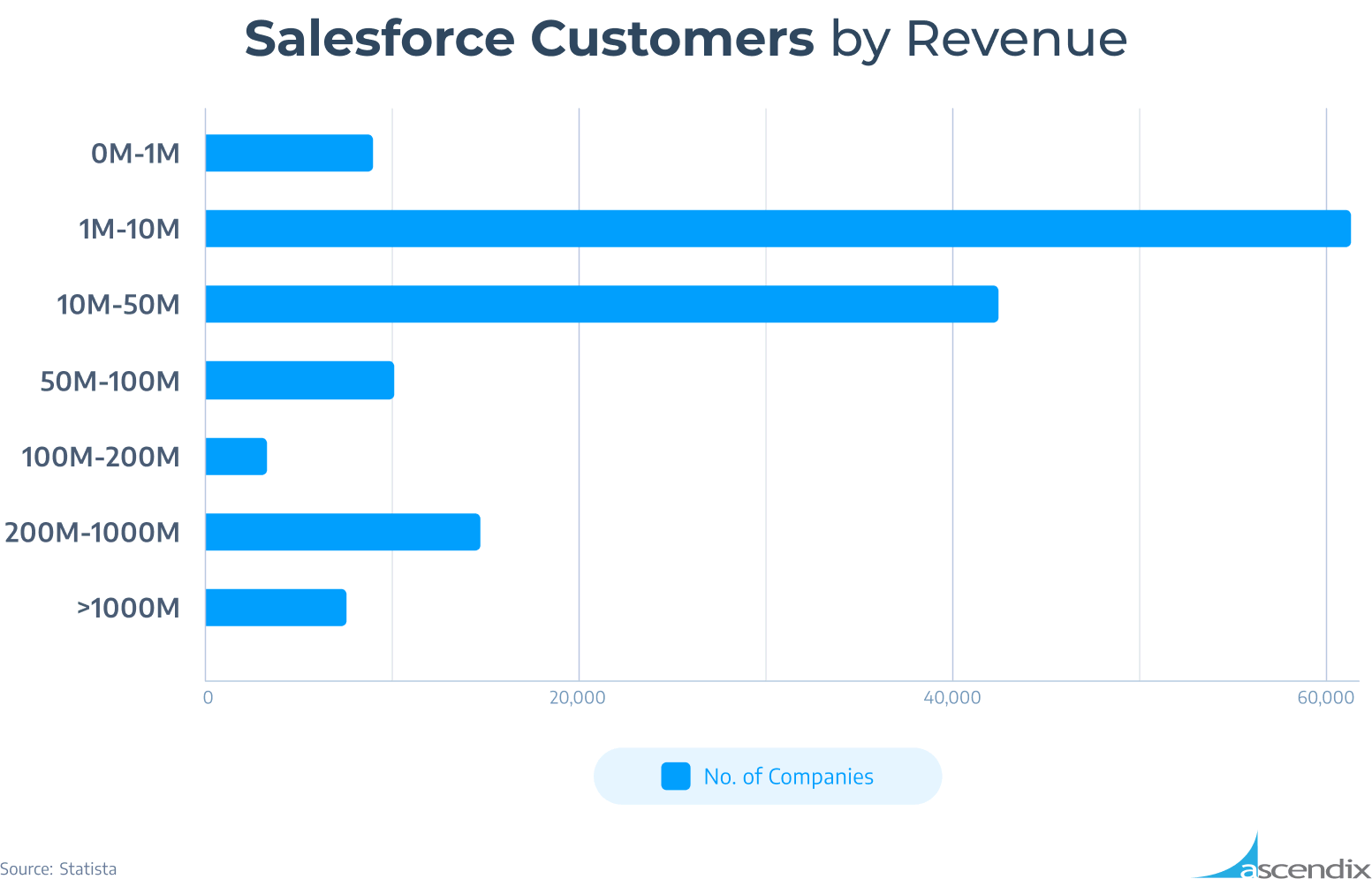

The Salesforce CRM is especially widespread among smaller companies – namely, businesses with annual revenue of between 1-10 million USD. Bigger businesses with revenue from 10 to 50 million USD come second, and huge companies with revenue up to a billion occupy the third place:

Salesforce Customers by Revenue

Salesforce CRM is used in various industries: from Commercial Real Estate and Private Equity to Higher Education and Non-Profit organizations.

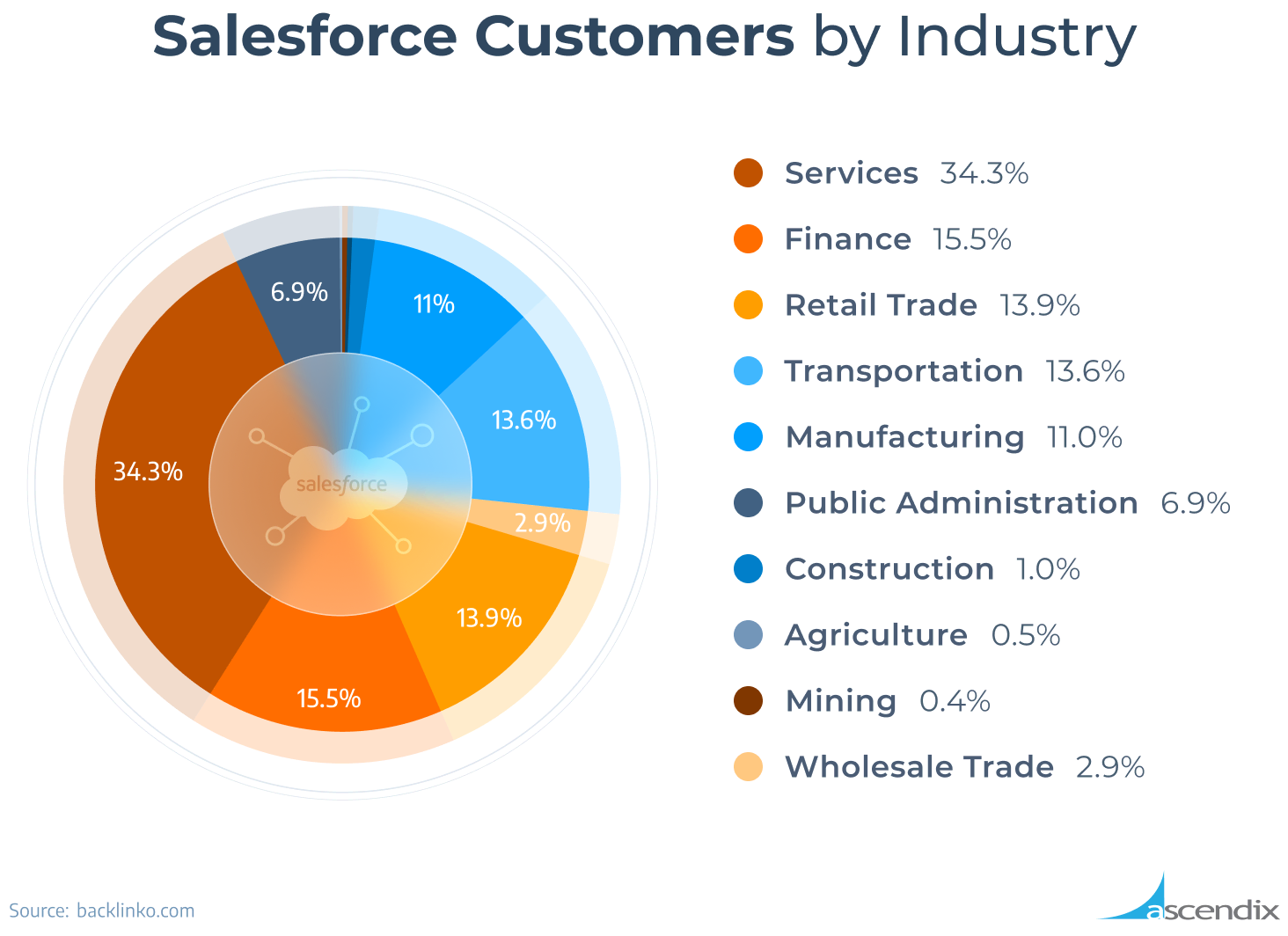

What industries use Salesforce most often? As of 2024, companies that use Salesforce most often represent professional services (29%), including but not limited to lawyers, advertising professionals, architects, and accountants. Other core segments are manufacturing (11.1%), financial and banking services (9.8%), and retail (7.8%). Salesforce is less popular in the sphere of consumer packaged goods (5.4%), and media (4.4%).

The most well-known companies that use Salesforce in the sphere of professional services are:

In the manufacturing sphere, these are BlueScope Steel, KONE, and Schneider Electric.

Salesforce Customers by Industry

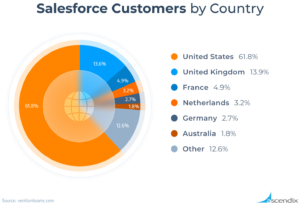

What countries use Salesforce the most? Around 61,8% of Salesforce clients come from the USA, specifically California (9,018 customers), New York (3,913), and Texas (3891) regions. The U.S. is then followed by the U.K. (13,6%) and France (4.9%).

Salesforce Customers by Country

Why is Salesforce so popular? The main reason for the popularity of Salesforce across the globe is that the company has developed a range of ready-made CRM applications specifically tailored to the needs of different industries and business departments. The company offers 12 industry clouds:

Most often, Salesforce customers utilize the platform to streamline sales operations, making convoluted sales processes more efficient and generating more leads, according to IDC (Source). Along with sales professionals, other teams like customer support can benefit from Salesforce CRM as well.

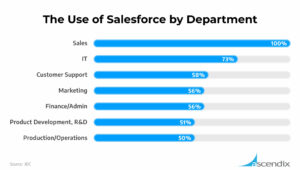

Who uses Salesforce in the company, if talking about departments? Traditionally, sales departments tend to use Salesforce the most. They are followed by IT departments, Customer Support, Marketing and Finance/Administrative departments. The usage of the Salesforce is less common among Product Development and Operations departments, as can be inferred from the graph below. Therefore, unlike the popular opinion that it is only Sales department which uses Salesforce, actually Salesforce helps to optimize the whole business, including all its elements.

The detailed distribution of Salesforce products for different departments is as follows:

Salesforce Statistics | Use by Department

Companies that use Salesforce expect the following outcomes from their newly adopted Salesforce solutions:

Regardless of the number of companies using Salesforce, perhaps the most astounding fact is that numerous Salesforce customer success stories report project payback of one year. Some companies who use Salesforce even report 58% payback in less than a year. The more compelling fact is that for some companies that use Salesforce, the ROI can be as high as 500%. Out of all existing customers who acquired the core Salesforce service, around 60% are eager to purchase additional clouds by Salesforce.

90% of the Fortune 500 companies leverage Salesforce to manage their business relationships in 2022, against 83% in 2017. Spotify, Amazon Web Services, Toyota, Walmart Inc., and among the top Fortune 500 companies that use Salesforce.

Below are some other Fortune 500 companies using Salesforce:

| Company | Website | Industry | Revenue |

|---|---|---|---|

| Walmart Inc. | www.walmart.com | General Merchandisers | 611 billion |

| McDonald’s | www.investor.mcdonalds.com | Food Services | 23 billion |

| UnitedHealth Group Inc. | www.unitedhealthgroup.com | Healthcare: Insurance and Managed Care | 357 billion |

| McKesson Corporation | www.mckesson.com | Wholesalers: Health Care | 276 billion |

| Macy’s | www.macysinc.com | General Merchandisers | 24 billion |

| Amazon.com | www.amazon.com | Internet Services and Retailing | 538 billion |

| Comcast | www.comcastcorporation.com | Telecommunications | 121 billion |

Walmart Inc. and Amazon are among the largest Salesforce customers, with revenues amounting to $611B and $538B, respectively.

Is Salesforce a fortune 500 company? Yes, Salesforce is honored to be listed on the Fortune 500 itself, ranking at #133 in 2023. It continues its upward climb to the top of the list, jumping 54 places from #190 in 2020 with a revenue growth rate of 29.1%. Since its creation, the company has shown consistent and stable growth in the list year by year, jumping for more than 200 positions since its debut in the list in 2015 (Source).

Salesforce is a leading CRM provider that since its creation has provided high-quality services and products. Having been founded in 1999, the company has shown exponential growth ever since, occupying a significant market share, outperforming competitors, and providing more and more advanced digital solutions for all kinds of businesses.

For 9 years in a row, Salesforce has been ranked the #1 CRM worldwide, and now it offers its products to the biggest companies in the world. Here, we explore the main questions about Salesforce’s position in the digital market.

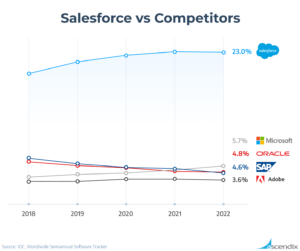

What is Salesforce’s market share? As of 2022, Salesforce occupies a significant market share of 23% in the worldwide software market, according to the latest Worldwide Semiannual Software Tracker by IDC. The company competes with 163 competitors in the sphere of CRM-providing services.

Salesforce and its competitors’ market share

Who are the top Salesforce competitors? The main competitors of Salesforce are Microsoft, Adobe, Oracle, and SAP. However, even combined, these four have a market share of just 18.7% compared to Salesforce market share of 23,36% as it has been already mentioned.

What is more, Salesforce products have the leading market share not only in the sphere of CRM services, but also among sales apps, customer care apps, and marketing apps, according to IDC (Source). Specifically:

Salesforce has shown significant growth over the years of its existence, both in the size of the company and in income. Over the last 20 years, the company’s revenue has grown at a CAGR of 51.22%. The company’s compound revenue growth over the last 10 years is 29.04%. The scheme below shows the exponential growth of Salesforce revenues within the period of last two decades.

Salesforce Annual Revenue

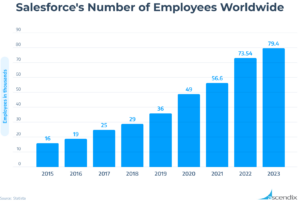

The Salesforce number of employees has gradually increased since its creation and has shown stable growth over the past years, as the company increased in size and occupied international markets. Currently, the number of employees at Salesforce is around 79,390 as of 2023, which is approximately 8% more than the previous number of employees in 2022 (73,541). The detailed number of Salesforce employees is shown below:

Salesforce’s number of employees

What is Salesforce revenue? Salesforce’s annual revenue hit an astonishing number of $31,35B in 2023 compared to the company’s $26,5B annual revenue accumulated in 2022 and just $21,3B in 2021 (Source).

The company’s future is more than promising. Salesforce revenue is projected to reach a new all-time high of 34.6B in 2024, followed by an eye-watering $50B in 2026, with the Salesforce’s year-over-year growth being 18%. Overall, Salesforce revenue in 2022 is 10x higher than 10 years ago.

Recently, the company has experienced a 14% increase in subscription and support revenues along with a 19% increase in professional services revenue (Source). Currently, both subscription and support services generate more than 93% of Salesforce revenue, accounting for around 29 billion USD in 2023 (Source). Though professional services constitute only around 7% of the company’s fiscal year revenue – slightly more than 2 billion USD as for 2023, we expect their share in the company’s total annual revenue to grow by the end of this year.

Along with that, the lion’s share of Salesforce annual returns comes from Salesforce AppExchange revenue + Subscriptions and Support (93.1%), while a mere revenue part comes from Professional Services and Other activities (6.9%).

Salesforce has four major products that it offers to the customers, with each of the products dedicated to a specific aspect of the business. The products are

The biggest chuck of the Salesforce revenue comes from “Service Cloud,” which generated nearly $7 billion in total revenue for the company in 2023. In the past, however, the primary source of the Salesforce revenue has been Sales Cloud, but this year it generated slightly more than 5 billion dollars – the third highest revenue among the company’s products, while still earning more than it did the previous year.

Salesforce Platform, which offers miscellaneous products, along with Tableau and MuleSoft, was second in revenue, generating around 6 billion dollars combined, which is 40% more than last year. With its marketing automation possibilities and commerce campaigns, marketing and commerce cloud came last, with 3,13 billion of revenue generated.

And that is not over! As you remember, according to Salesforce statistics (Source), 86% of customers use partner apps and solutions. This means that Salesforce is not only four cloud services, but it should be viewed as the whole ecosystem of related products, add-on cloud subscriptions, and IT solutions offered by CRM consulting companies and software developers, guiding Salesforce customers along CRM implementation and integration paths.

One such company is Ascendix – a major Salesforce partner, consultant, and software developer with over 26 years of experience in the CRM business.

Leverage almost 2 decades of Ascendix’s Salesforce experience today.

IDC estimates that the global Salesforce ecosystem is 5x bigger than Salesforce itself, meaning that for every dollar Salesforce made in 2021 as a part of its revenue, the ecosystem made $4.96. And that number is projected to grow to $6.19 by 2026.

Salesforce Ecosystem

The biggest Salesforce market is the Americas, contributing to approximately 20 billion USD of revenue in the company, with annual revenue growth of 22,3 % coming from customers located in North and South America.

Europe comes second in the division of revenue, bringing in 4,5 billion USD annually. However, the situation may well change in the nearest future, as the income from European customers has increased already by 31%, outreaching the global company growth rate, as well as the American and Pacific areas.

The Asia Pacific territory is so far the smallest market in the geographical division of Salesforce profits. With annual revenue of around 2 billion USD and growth rate of 24%, Asian market is highly likely to stay at the third place for some time in the future.

Speaking globally, Salesforce and its cloud products ecosystem are projected to generate up to 1.6 trillion in worldwide revenue, which includes the value that Salesforce customers will add up to their local economies by using the cloud services provided by the company. The region with significant additional revenues of more than 50 billion USD will be the USA (531 billion), followed by Japan (97,4 billion), Germany (94,4 billion) and the UK (71,6 billion).

Salesforce Revenue Worldwide

Overall, Salesforce is actively used worldwide, and, regardless of the territory, it contributes positively to other businesses growth and development, unifying the processes and easing up the operations.

Salesforce’s rapid growth is highly attributed to the immense number of company acquisitions and subsidiaries. They have played a crucial role in strengthening Salesforce’s position in the technology industry and enhancing its ability to deliver comprehensive solutions to its customers. Here we discover more about Salesforce’s strategy in acquiring companies and owning subsidiaries by answering the most common questions about the company.

Who did Salesforce acquire recently? The most recent big Salesforce acquisition is the workplace messaging service Slack, which provides inner business communication along with multiple additional services and integration possibilities. The deal was announced in December 2020, and was fully completed in July 2021 (Source). So far, Slack has set a record in the sphere of software acquisitions, with the deal worth of 27.7 billion USD.

The benefits of this collaboration are more than promising: the major aim of this Salesforce acquisition was to integrate Slack’s popular messaging and collaboration tools into its CRM ecosystem. The acquisition was a strategic response to the growing importance of remote work and the need for seamless team communication and collaboration. Salesforce’s acquisition of Slack marked a significant move for the company in its quest to become a comprehensive digital workplace platform.

The deal was perhaps one of the most fruitful investments, which increased Salesforce’s revenue by almost $600 million during the latter half of fiscal year 2022 and is projected to add an additional $1.5 billion to Salesforce’s total revenue for the fiscal year 2023 (Source). Like many other Salesforce’s acquisitions, Slack can now be found on Salesforce’s marketplace – AppExchange, being a valuable and beneficial addition to Salesforce’s ecosystem.

In 2022, Salesforce has followed the strategy of acquiring companies that would strengthen the existing ecosystem and support the infrastructure. Therefore, the company has completed 3 major acquisitions – a consultancy firm Traction on Demand, a compliance services vendor Phennecs, and Troops.ai, a sales automation bots provider.

Salesforce Acquisitions Over the Years

How many acquisitions has Salesforce made? Since the company’s creation, Salesforce has acquired 70 companies to date, including Tableau, MuleSoft, Demandware, ExactTarget, Vlocity, and Slack. These investments amounted to $29.1B in 2020. The biggest number of acquisitions happened in 2016, when Salesforce acquired 12 companies in a single year. The most significant Salesforce acquisitions were Slack (27,7 billion), Tableau (15,7 billion), and MuleSoft (6,5 billion). Overall, Salesforce has spent over 70 billion USD on its acquisitions.

What subsidiaries does Salesforce have? While it is difficult to identify Salesforce subsidiaries and differentiate them from separate services provided by Salesforce itself (like Pardot), Quip, Heroku, MuleSoft, Tableau, SoftwareAcumen Solutions, and Slack Technologies are most often considered Salesforce subsidiaries. Some sources also name Datorama, Inc., ClickSoftware Technologies, Demandware, Inc., BeyondCore and Clipboard as Salesforce subsidiaries. We have collected the entire list of Salesforce subsidiaries below:

| Subsidiary | Product |

|---|---|

| Mulesoft | Integration software for connecting applications, data and devices |

| Datorama | Marketing and advertising data management software |

| Clipboard | Short-term data storage and transfer software |

| Coolan | Data analytics platform |

| Heroku | Industrial IoT platform |

| Quip | Productivity software |

| ClickSoftware Technologies | Workforce and service management software |

| Tableau | Financial services and analytics software |

| Slack | Productivity and communication platform |

Here you can find more information about Salesforce Subsidiaries and their market projected growth:

The Salesforce statistics say that the company had 79,390 employees globally in the 2023 fiscal year – almost 60% increase since 2020. Most Salesforce employees (58%) are based in the US, while 42% are spread across 84 international Salesforce locations and 95 offices worldwide.

Salesforce managed to increase the number of employees by almost 8% in 2023 compared to 2022 despite a hiring freeze which happened in November 2022 and continued up to January 2023, when the company announced it intended to cut its workforce by 10 percent, or around 8,000 employees (Source).

However, it is worth mentioning that Salesforce number of employees has incredibly increased over the last 2 decades: in 2005, Salesforce had only 767 employees. Now compare the number to almost 80 000 employees in 2023 – pretty impressive, right?

Salesforce’s number of employees

But answering ‘how many employees work for Salesforce’ is not enough to get the full idea of the work culture and values Salesforce represents as an employer. Apart from being diverse geographically, Salesforce also does its best to welcome minorities, LGBTQ employees, and people of all genders, ages, and abilities. In fact, 50.7% of Salesforce employees represent underrepresented groups (Source).

This is one of the reasons why Salesforce has been ranked on the FORTUNE 100 Best Companies to Work for List for 14 years in a row. The firm scored #8 in 2023.

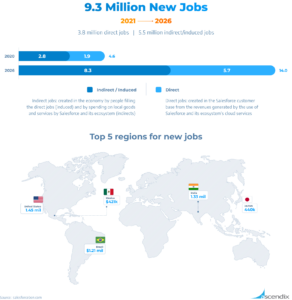

Apart from that, Salesforce and its partner ecosystem are largely contributing to the global workforce economy. It’s also expected that by the end of 2026, Salesforce will have created 9.3 million jobs worldwide and $1.6 trillion in new business revenues globally by 2026.

New Jobs Created by Salesforce

This includes 3.8M direct jobs created from the use of Salesforce and its partners’ solutions and 5.5M indirect opportunities created by local spending by direct employees and Salesforce and its partners.

So, Salesforce is not just a family of successful products but also an ever-growing ecosystem of partners and related products contributing to the global economy.

Change the way you use Salesforce, get the most of your data, and unleash hours to reach your goals.

As a company leading in the CRM market, Salesforce is at the forefront of digital transformation, helping both prominent companies and startups leverage their data, skyrocket productivity and customer satisfaction – hence, expand their annual revenues. That’s why amidst the AI and GPT hype, Salesforce was the first company to confidently step on the path of AI development in real estate, particularly generative AI.

What is generative AI and why is Salesforce so passionate about it? A generative AI model introduces new opportunities to Salesforce users by synthesizing images, text, videos, and sounds to create a simulated world. Due to the data fed into the system, generative AI is constantly learning and upgrading itself.

In March 2023, Salesforce announced the launch of Einstein GPT. Being a generative AI, Einstein GPT is custom-built for CRM (and is already a part of the Customer 360 platform) and integrates with OpenAI (particularly, ChatGPT technology) as well as all Salesforce clouds, Tableau, Slack, and MuleSoft. As an AI-powered tool, Einstein AI generates content like personalized emails (helpful for marketing teams and sales representatives) and responses to clients (beneficial for customer care teams). It also automates code generation for developers.

Lately, the company has brought its AI development endeavors to a whole new level. In June 2023, Salesforce announced the launch of an AI Cloud (base-built on Einstein GPT) aimed to deliver AI capabilities through all company’s clouds and ensure AI-powered task management, customer behavior analysis, sales and marketing management, and other processes that grow Salesforce clients’ revenue and their presence on the real estate market.

Salesforce recognizes the security data issues which AI presents, so to ensure the safety of their customer data, the company has built the AI cloud on the Einstein GPT Trust Layer as well: users can train AI models on their own data without fearing it would get hacked.

Built on the top of Einstein GPT, AI Cloud brings together multiple systems under one roof:

Sales GPT – Email auto-generation, automatic meeting scheduling, etc. Here, we should also mention the Sales AI feature. Built as an extension of Sales Cloud, Sales AI drives better sales results, helping users automate and personalize sales-related tasks with Einstein GPT;

Service GPT – Coming as an add-on feature in the Service Cloud, Service GPT auto-generates personalized replies in customer service chats;

Marketing GPT – Personalized web and advertising content generation;

Slack GPT – Collaboration tools come to a new level with AI – Slack GPT summarizes conversations for users, offers AI-driven research, and auto-generates message drafts.

Einstein GPT for Developers – Development teams can use the AI chat assistant for smart code generation or ask the digital assistant questions related to Salesforce large language models.

Salesforce AI-powered Solutions

We don’t know how many companies leverage Salesforce AI, but what we do know is that among them already are Gucci, Inspirato, RBC US Wealth Management, and other titans – obviously, it won’t take long before other Salesforce clients join the AI club.

Currently, Salesforce Ventures is expanding its Generative AI Fund (from $250 million to $500 million) with a noble intention to help high-potential AI startups devoted to the development of generative AI.

As both a venture capital company and software developer in the CRM market, Salesforce has already invested in Anthropic, Cohere, You.com, and Hearth (Salesforce will host their large language models within its infrastructure).

The above-mentioned data points out the extensive growth of Salesforce over the past decade. Let’s now add more key facts and milestones in the Salesforce development that highly contributed to the platform’s success.

Except for various products, services, and clouds, provided by Salesforce, and multiple subsidiaries, the company also introduced an innovative platform for Salesforce’s fans to exchange ideas – AppExchange.

Salesforce AppExchange is the world’s leading enterprise cloud marketplace, designed and managed by Salesforce itself. It serves as a platform for third-party developers to create, showcase, and distribute applications that integrate seamlessly with Salesforce’s suite of products. These applications, often referred to as “apps,” are built to extend the functionality of Salesforce’s CRM and cloud-based solutions across various industries and use cases. These apps can be easily installed into Salesforce.org to enhance and customize the CRM experience for businesses, and for this reason, many customers rely on AppExchange to tailor their CRM to their unique requirements.

The service is available for a subscription fee, which is paid by the third-party app providers. The system is highly beneficial and fruitful for both Salesforce and the developers, occupying a big part of Salesforce general income. The AppExchange revenue is not disclosed by Salesforce; however, IDC thinks Salesforce generated $20 billion in 2020 revenue for its 2,000+ ISV partners. In 2022, Salesforce announced that the number of AppExchange installs exceeded 10 million (Source), so we can only guess how much it generated for the company.

There are more than 3,400 apps on AppExchange that Salesforce customers may use to make the most out of their CRM platform. Some of these apps help Salesforce CRM adopters to augment their CRM platform with advanced search and filtering functionality like radius search (Ascendix Search), while others empower Salesforce CRM users with convenient flyer generation features available right from the Salesforce interface (Composer).

Salesforce can also be called one of the most sustainable global companies. Since 2013, Salesforce has been working to drive the global transition to clean and renewable sources of electricity.

Salesforce achieved its goal in 2021, reaching 100% renewable energy and net-zero emissions across its full value chain. In fact, 7.39% of Salesforce customers rated the company’s cloud solutions as beneficial in supporting their sustainability efforts.

If you decide to migrate to Salesforce as your main CRM platform, you will definitely face several issues like what Salesforce Cloud to opt for and how to tailor the existing Salesforce functionality to your business needs to make the most out of your new investment.

This is where Salesforce consulting partners come into play, empowering new Salesforce customers with Salesforce-specific wisdom for successful AppExchange development, CRM customization, and configuring of their Salesforce solutions.

Ascendix Technologies is a Salesforce Crest [Gold] Consulting Partner and software development firm purely focused on the technical side of Salesforce and other top CRM platforms. We have been supporting the CRM needs of the world’s top companies for more than 26 years now. Check our case studies for more details.

Besides that, Ascendix offers:

If you have a Salesforce project in mind but don’t know how to bring it to life, contact us and let us know your business challenges or check our Salesforce Quick Start packages to get assistance out of the box.

90% of Fortune 500 companies use Salesforce for enhanced customer relationship, sales, and marketing management. Among them are Amazon Web Services, Spotify, Bharat Petroleum Corporation, and others with an average revenue of $8 million.

More than 150 000 companies are using Salesforce at a global scale in 2024, but Salesforce number of customers keeps growing further. Most Salesforce users come from the United States – 62%, followed by customers from the United Kingdom – 16.5%, France – 4.6%, and Netherlands – 3.2%.

Companies who use Salesforce most often represent professional services – 29.2%, manufacturing – 11.9%, finances – 9.7%, and retail industries – 8.5%. Other industries where companies use Salesforce are consumer packaged goods – 4.9%, construction and real estate – 3.1%, and others.

Alina is a forward-thinking writer specializing in Salesforce Consulting, Ascendix Products, and best commercial real estate practices. She shares her insights in engaging yet informative posts to help businesses get the most value out of the latest industry news and trends.